Content

By doing so, debt information will never be held on the smart phone. Occasionally, a cellular deposit can take expanded to help you procedure and require an excellent keep. SmartBank have a tendency to email you to definitely reveal if we you want to hang a cellular put and can include details of when to anticipate the amount of money getting offered. Along with, non-reviewed company accounts qualify to utilize mobile deposit. Following the teller have canned the consider, they will render an acknowledgment summarizing the transaction and money if you questioned it. Review the new bill very carefully to make sure the facts try proper and matter hardly any money provided.

Which are the restrictions away from cellular take a look at places? – casino Fabulous Bingo mobile

When you’ve verified everything appears proper, faucet “Submit” or a similar key inside software in order to finish your put. The bank’s program validates the fresh view by confirming navigation and you may membership quantity, examining to have copies, and you may examining image quality. Inaccuracies get punctual manual review, where the bank assesses the fresh deposit up against the representative’s account background to own abnormalities.

- Somewhat the same percentage algorithm is employed various other banking tips via devices, including Siru mobile fee, Boku or PayforIt.

- You could have the possibility to invest a payment for your fund becoming readily available the same or the following day.

- This particular feature limits the quantity you’re also capable deposit in your mobile device for every working day.

- Cellular put is especially smoother if you wish to put an excellent consider just after regular business hours, on the a lender escape, if you don’t more than a sunday.

- Sure, their cellular put restrictions are given for every qualified account when you choose in initial deposit in order to account and on the brand new Enter into Count screen.

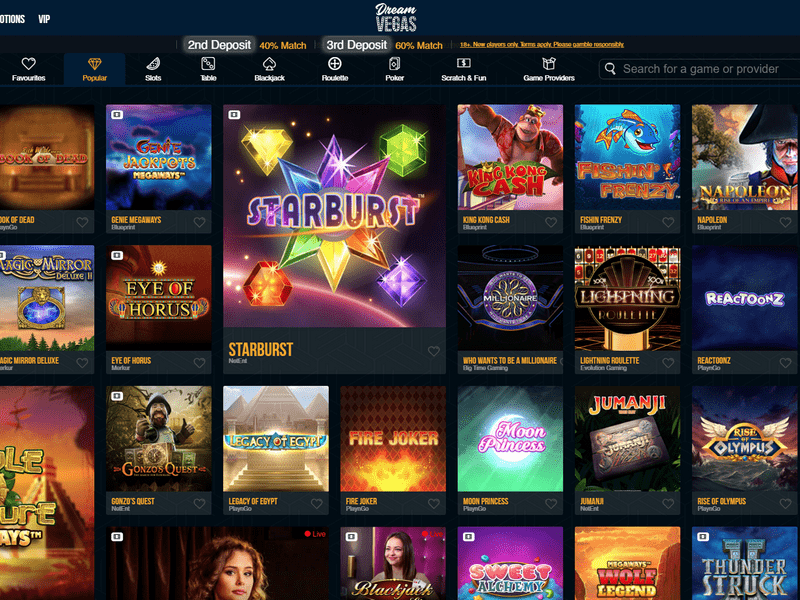

Whether or not your own cellular put seems to go off instead an excellent hitch, it does be a smart idea to retain the newest report take a look at just after they clears, and if there’s difficulty later. Mobile look at deposit try a cellular banking equipment that allows you to deposit checks for the checking account using your mobile device. In summary, shell out by cellular gambling enterprises render an instant, safe, and associate-amicable means to fix deposit money with your portable bill or prepaid service balance. That have various games, bonuses, plus the capability to manage your bankroll easily, cellular telephone expenses gambling enterprises are very a leading choice for of numerous on the web casino followers. By leveraging cellular asking features, people can also enjoy instantaneous places without needing to share sensitive and painful financial suggestions, making certain one another convenience and reassurance.

You are notified of your own limitations once you you will need to create a deposit. After you’ve reached the restriction, you will not be able to build other deposit before the overnight otherwise month. Mobile look at put has arrived to stay, and its coming appears guaranteeing.

Cellular costs are in anyone domain name because the 1990s, in the event the enjoys out of Sony Ericsson and you will Coca-cola experimented with to shop for merchandise via Texts. Intentionally depositing the same cheque over and over again is regarded as con. Fraud is actually a significant unlawful offense that is punishable by a great prison sentence.

Have to have the HSBC Cellular Financial application?

When you’ve finished to make their deposit, keep your take a look at until the full count provides cleaned your bank account. Your financial could possibly get suggest that you keep the seek out a good particular several months, such four so you can seven days. Just after the look at has removed and you feel safe getting rid of your own look at, shred they or damage it properly. Check your software’s cellular view deposit tips to make sure you’re also writing a proper statement ahead of continuing.

If you have a hold on tight your bank account unconditionally, you do not manage to deposit a check utilizing the mobile application. You will need to get hold of your bank to resolve the fresh hold before making in initial deposit. Immediately casino Fabulous Bingo mobile after deposit a check with the mobile app, it’s vital that you properly store the newest physical seek a few weeks in case there is any problems with the new deposit. Make an effort to wait until the newest go out to the look at just before placing it. – Bank A need a mobile deposit limit away from $2,five hundred per day and you may $5,one hundred thousand for every 30-day months.

Here’s a listing of the new mobile look at deposit constraints at the big banking institutions you could site. If you ever have to reference the pictures your grabbed of your mobile take a look at put, your own lender can offer the choice to take on him or her whenever your availableness your own declaration. Really mobile financial programs do not allow one to shop images of the inspections you put on your cellular telephone. With a mobile financial app, you could control your funds out of your mobile phone without having to sit down at the a pc otherwise see a department of your own lender. It’s even more an easy task to totally digitize debt existence, relying on borrowing from the bank and you can debit cards to own sales, using applications to send money for the family members, and you can paying expenses online. Cellular look at put, also known as cellular deposit, allows you to deposit report checks into the savings account using a mobile application on the mobile phone.

With cellular take a look at deposit, you might put a check during your mobile phone otherwise pill, and the procedure only takes one to three minutes. In other words, you don’t need to use your time and effort and you may gasoline currency to visit a bank part otherwise Automatic teller machine, therefore don’t need to bother about . Should your newest membership doesn’t render this particular feature, it may be value evaluating checking accounts discover one that has mobile consider deposit or other beneficial digital financial has.

Compensation could affect the region and you will order where such companies show up on this site. All the including place, order and business analysis try at the mercy of alter centered on article decisions. Mobile Take a look at Deposit makes you put your checks instead an excellent trip to the bank. Utilize the Citi Mobile banking App to deposit your future look at along with your mobile phone.

More often than not, the brand new placed financing are available to you the day after the deposit are credited. But not, never assume all account qualify to own mobile dumps, there is limits about how exactly far currency will likely be placed that way. The newest cellular put function is made to end up being representative-amicable and you can secure.

Electronic banking identifies the connections from banking that have technology. This means that electronic financial comes with such things as on the internet banking away from the desktop computer plus the on line services one banking companies offer, including payroll devices an internet-based transfers. Chase’s website and you may/or cellular words, confidentiality and you will shelter formula usually do not apply to the website or software you are planning to visit. Delight opinion the terminology, confidentiality and you may shelter regulations observe the way they connect with your. Pursue isn’t responsible for (and you may will not offer) one things, features or blogs at that third-team web site or app, with the exception of products one to clearly hold the new Chase name. With Pursue to have Team your’ll discovered information of a small grouping of company professionals who specialize in assisting boost cash flow, taking borrowing from the bank options, and you can controlling payroll.

Fortunately, for those who financial having a lender who’s a mobile app, you will possibly not must see a department in order to put an excellent take a look at. Rather, chances are you can deposit a check from anywhere having fun with merely their mobile. Mobile consider put is actually an instant, easier way to deposit fund with your mobile device.

If you make problems whenever endorsing a check or taking pictures of one’s consider, it can cause debt institution in order to refuse your own look at. You may have to hold off to work through one items otherwise feel a delayed obtaining your own finance. Taking these steps is also greatest protect your finances and personal information while using your unit to help you deposit checks or over most other financial tasks.